The Gramm-Leach-Bliley Act (GLBA), which repealed the Glass-Steagall Act, includes multiple provisions designed to protect the confidentiality and integrity of customers’ nonpublic personal information. In order to demonstrate good stewardship of consumer data — and to avoid civil penalties — financial institutions are required to comply with these provisions.

But achieving compliance is often easier said than done. It’s more than just the flip of a switch; it requires careful planning, routine assessments, compliance training and more. That’s why we’ve created this free GLBA compliance checklist to help your firm create a foolproof strategy for getting — and staying — compliant.

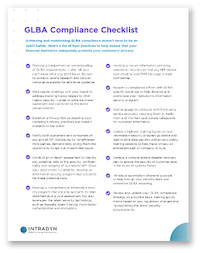

Checklist items include:

- Checklist items include:

- Establishing a Privacy Notice

- Conducting an in-depth risk assessment

- Appointing a GLBA-specific compliance officer

- Developing a comprehensive disaster recovery plan

- And more